GEODNET: The $8M ARR Robotics Token On Track for $50M ARR by 2027

TLDR:

Provides precise positioning for robots, drones and autonomous vehicles through their GNSS network built with crypto incentives.

$8.3M ARR (3x YoY growth up from $2M ARR in late 2024)

80% of revenue → direct token buyback and burn

Paying enterprise customers: Quectel ($2.5B revenue), Propeller Aero ($25M+ funding), plus ag/construction/drone companies and partnerships with USDA

The Setup:

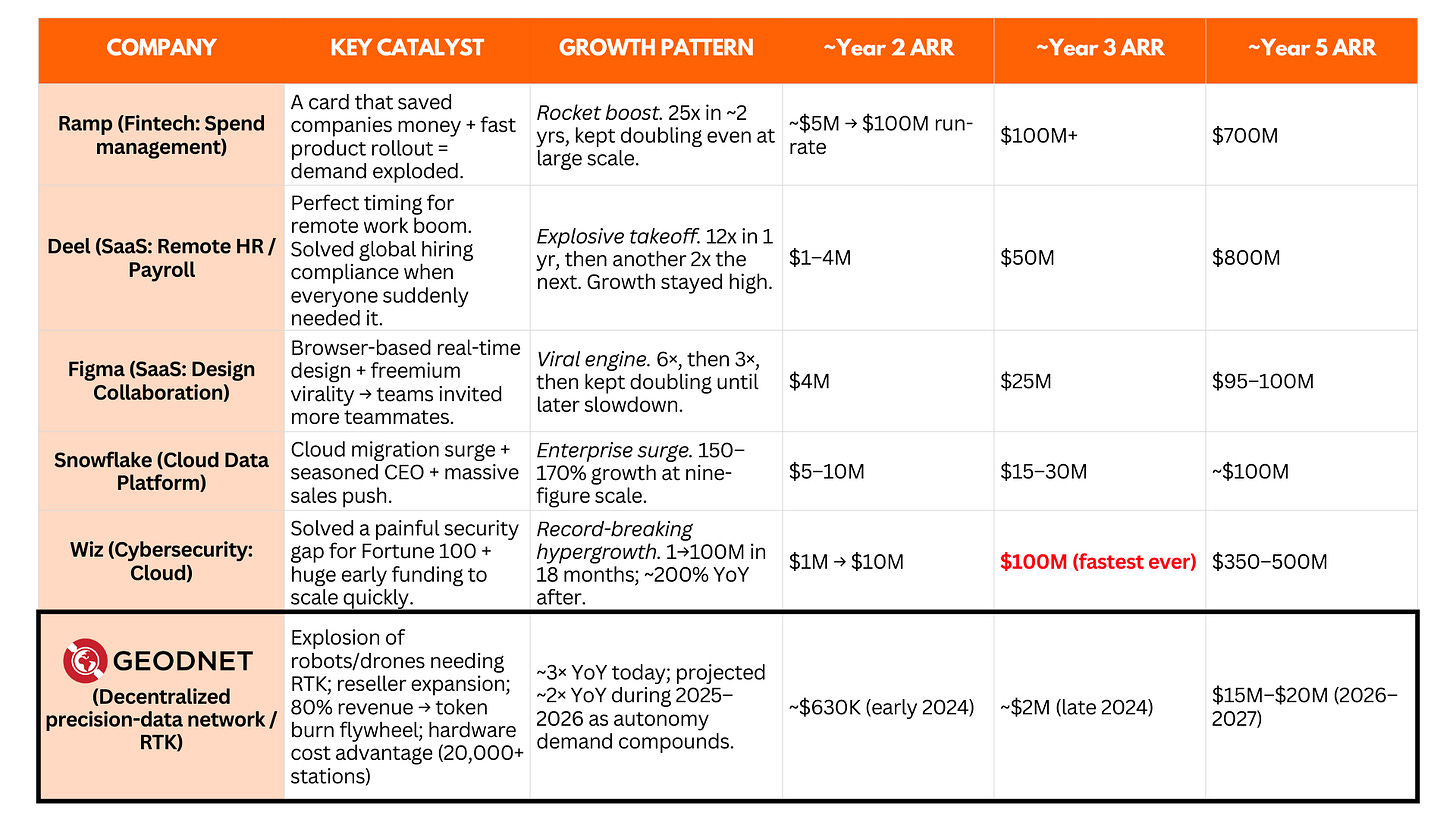

GEODNET is sitting at the exact inflection point where Ramp went from $6M to $100M ARR in 18 months, where Deel exploded from $5M to $100M+ in under two years, and where Wiz hit $100M ARR faster than any software company in history.

The pattern is always the same: a large, emerging market with slow early traction, followed by a breakout around $5–7M ARR, and then a clear inflection point where growth turns vertical and PMF is crystal clear. GEODNET just crossed that line, growing 3x YoY, in a market (robotics/autonomy) that’s exploding right now.

Here’s why Crescendo believes that this is one of the few tokens that outperforms in this market. Disclaimer: This is NFA and we advise the Geodnet team on growth.

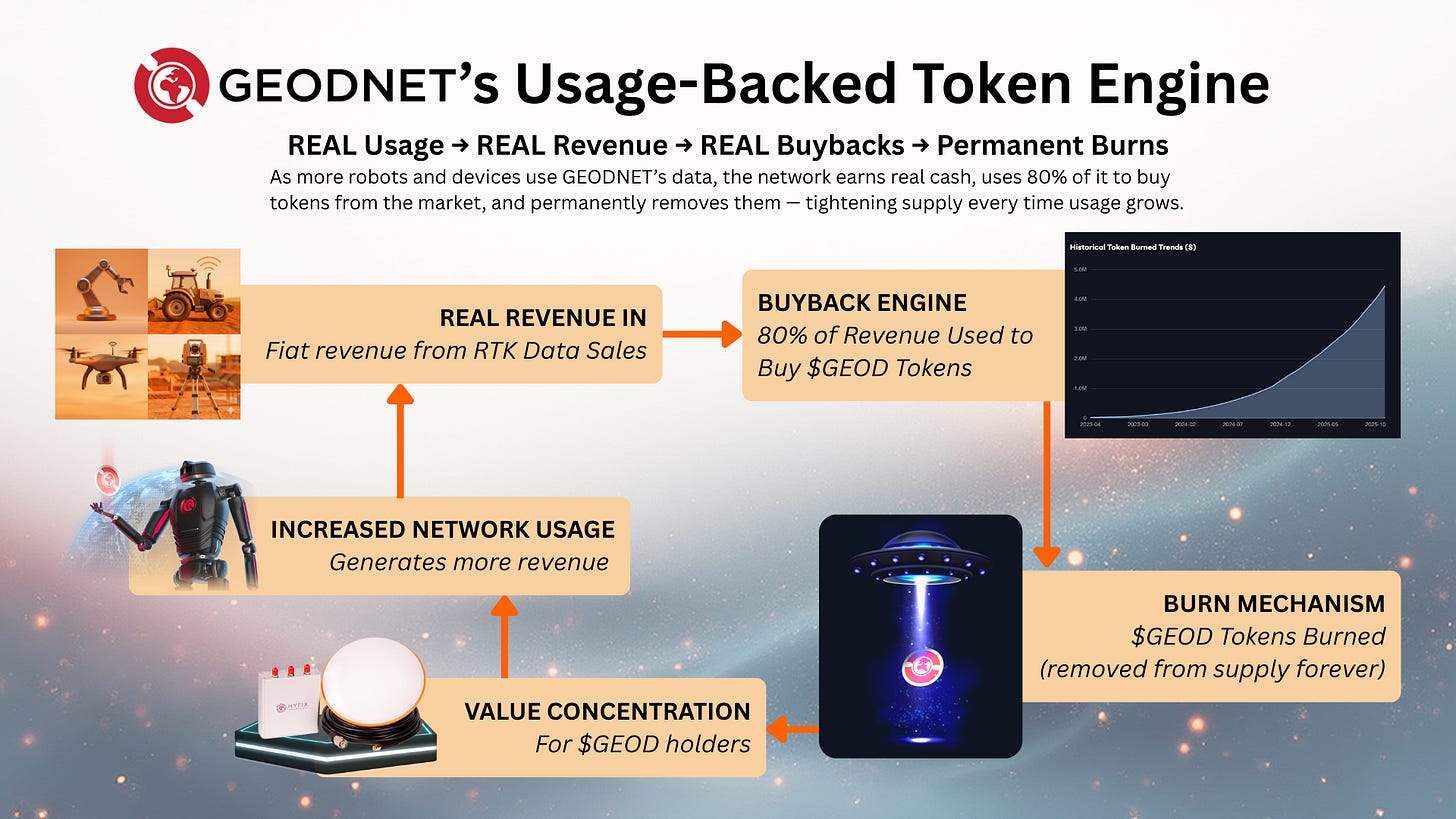

How $GEOD Accrues Value

Most crypto projects have pure speculation driving their tokens. GEODNET’s token is directly tied to revenue through an 80% buyback and burn mechanism.

How it works:

Enterprises pay fiat for GPS correction data (centimeter-level accuracy for robots/drones/autonomous vehicles)

80% of that revenue buys $GEOD on the open market

100% of those buyback tokens are permanently burned: they are not redistributed, not reallocated, and never re-enter circulation

The remaining 20% of revenue funds operations: infrastructure, hardware deployment, engineering, and network growth. This allows GEODNET to operate sustainably while routing the majority of value back to the network.

The math:

At $2M ARR (late 2024): ~$1.6M/year in burns

At $8M ARR (current): ~$6.4M/year in burns

At $50M ARR (2027 projection): ~$40M/year in burns

Burns grew ~300% YoY. Meanwhile, token emissions decline over time due to halvings and a 1B hard cap. The supply/demand dynamics get tighter as the network scales.

This is essentially a continuous equity buyback, except burned tokens can never return to circulation. Every burn permanently increases the value capture of remaining supply.

Growing and Sticky Sticky Revenue

Unlike 99% of crypto projects, GEODNET launched with paying customers from day one and has been growing revenue through a bear market:

Q1 2024: $630K ARR

Q4 2024: ~$2M ARR

Q2 2025: $7.2M ARR

Early Q1 2026: $8.3M ARR (current)

Conservative projection applying the same 3x growth pattern: $20M+ ARR by end of 2026, $50M+ by 2027.

This growth is driven by real-world usage from enterprise customers who depend on centimeter-level positioning for production systems, not speculation.

Concrete enterprise integrations:

Quectel — $2.5B annual revenue, 100M+ IoT modules shipped annually; GEODNET integrated directly into robotics and GNSS hardware

Propeller Aero — leading drone-mapping company with $25M+ in funding and 100M+ processed drone images

Broader real-world use cases already live:

Agriculture automation firms running autonomous tractors in Australia

Construction companies using GEODNET for surveying and site automation

Drone delivery and UAV tracking operators requiring centimeter-level positioning

These are real companies paying real money because the product solves a real problem: standard GPS drifts 3-5 meters, robots need centimeter-level accuracy to function. A drone missing its landing pad by 3 meters isn't a minor inconvenience; it's a crashed drone.

The upside of enterprise customers means that revenue is completely non-correlated to crypto cycles or volatility. Additionally churn is practically non-existent in this customer segment.

The Market Timing (Why Now Matters)

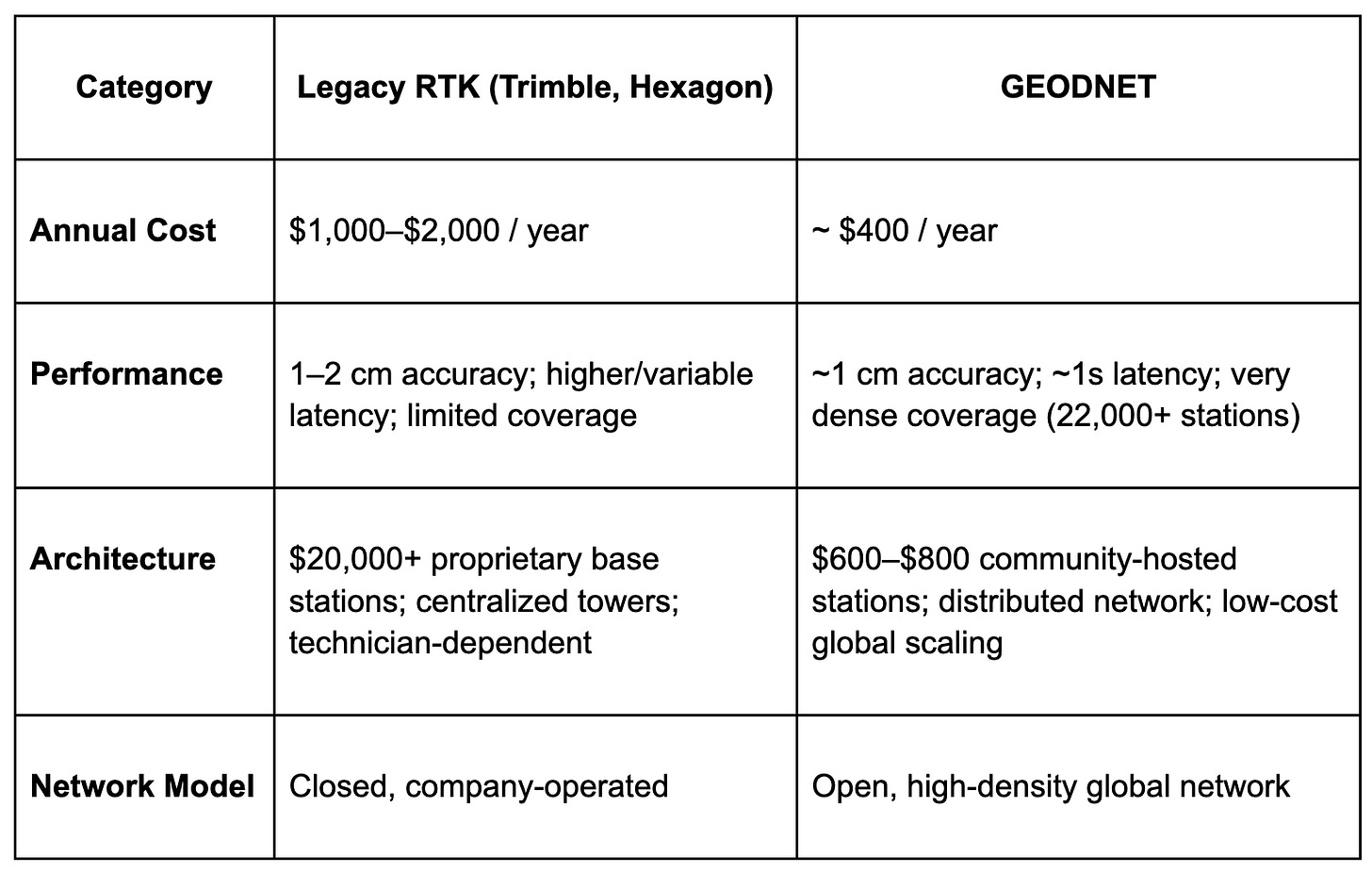

The precision GPS market is already multi-billion and growing ~10% annually, but it’s been locked up by legacy providers (Trimble, Hexagon) charging $1,000-2,000/year with high latency.

GEODNET delivers the same (often better) accuracy for ~$400/year with 1-second latency. The cost advantage is structural:

Legacy: Proprietary $20K+ hardware, field technicians, centralized infrastructure

GEODNET: $600-800 stations, community-hosted, blockchain coordination

The unlock: Every autonomous system coming online needs this. Not wants it, needs it.

Robotaxis need lane-level localization

Agricultural robots need sub-inch accuracy for auto-steering

Construction robots need exact positioning on job sites

Delivery drones need precise landing

AR/VR needs pinpoint spatial accuracy

40% of agricultural GPS receivers already use RTK corrections because precision farming literally doesn’t work without it. That same shift is now hitting every industry adopting autonomy.

And autonomy adoption is accelerating: autonomous vehicles, warehouse robots, delivery bots, agricultural automation, construction tech, drone delivery. Every one of these needs centimeter-level positioning.

The Network Effect (Why This Compounds)

GEODNET has a true physical network effect:

More stations → denser coverage → higher accuracy → more enterprise customers → more revenue → more node incentives → more stations

They’ve already deployed 22,000+ stations across 155 countries, making it the largest precision-positioning network globally by node count. It overtook Trimble’s decades-old network in under two years. Trimble has a nearly $20 Billion market cap.

The reseller model amplifies this: partners like Quectel package GEODNET corrections into their hardware and software, typically on 50/50 revenue splits. GEODNET grows because other companies grow alongside it, keeping overhead low while expanding reach.

This creates a compounding moat. Replicating 22,000+ stations isn’t just expensive, it requires GNSS expertise, token incentive design, and enterprise partnerships that few teams can execute.

The Comparable Analysis (Where Price Could Go)

Let’s look at how the market values comparable infrastructure plays at different ARR stages:

Traditional SaaS multiples:

Early growth (sub-$10M ARR): 15-25x revenue

Hypergrowth ($10-50M ARR): 25-50x revenue

Proven scale ($50M+ ARR): 20-40x revenue

Crypto infrastructure premiums:

Helium at peak: ~50-80x forward revenue

Render: ~30-50x forward revenue

Filecoin at various points: 20-60x forward revenue

GEODNET currently sits at approximately $68m in market cap = ~8x revenue. Undervalued by both crypto and SaaS standards.

Scenario modeling:

Conservative (8x multiple):

At $20M ARR (late 2026): $160M market cap

At $50M ARR (2027): $400M market cap

Base case (15x multiple in line with SaaS multiples):

At $20M ARR: $300M market cap

At $50M ARR: $750M market cap

Bull case (40x multiple, matching high growth SaaS + crypto infra premiums):

At $20M ARR: $800M market cap

At $50M ARR: $2B market cap

Current market cap: $68M

The asymmetry is obvious. If GEODNET simply maintains its current growth trajectory and gets valued like comparable infrastructure, we’re looking at 5-20x upside by late 2026.

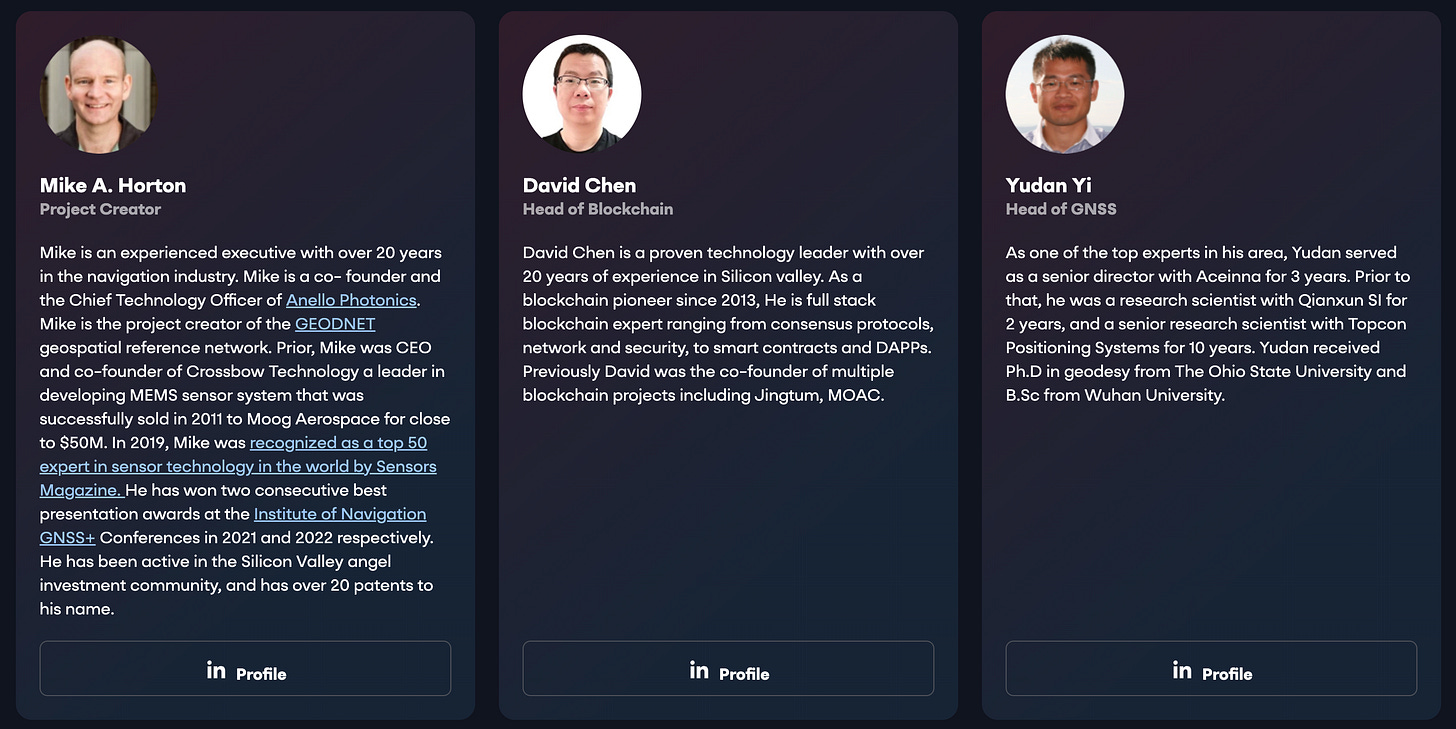

The Team & Backing

Founder: Mike Horton, previously founded Crossbow (over $150M in delivered revenue, and acquired by Moog Inc. in 2011 for $32 million). This isn’t his first rodeo in positioning tech.

Investors:

Animoca Brands (backed during bear market)

ParaFi Capital

VanEck

VanEck’s involvement is particularly notable; major asset managers don’t typically disclose small-cap token positions unless conviction is high.

The Risks (What Could Go Wrong)

Competition: Trimble or Hexagon could slash prices 80% to compete. However, their cost structure makes this difficult; they’d be operating at a loss while GEODNET’s decentralized model gets cheaper with scale.

Adoption risk: Autonomy could take longer to scale than expected. Counter: agriculture already shows 40% RTK adoption, and GEODNET is growing 3x YoY regardless.

Token liquidity: Smaller market cap means potential for volatility and slippage on larger trades. Entry/exit planning required.

Execution risk: Network effects require continued station deployment. If node growth stalls, accuracy improvements slow.

Regulatory: Potential issues with token mechanics in certain jurisdictions, though the utility-driven model is less exposed than pure speculation tokens.

Tech disruption: Alternative positioning tech (though GPS/GNSS is entrenched infrastructure, not easily replaced).

Near-Term Catalysts (What to Watch)

2026:

Potential $20M ARR milestone hit earlier than projected

GEO-Pulse consumer device scaling

Additional enterprise integrations

Network expansion into underserved regions

New hardware products supporting GEOD ecosystem

Next token halving reduces emissions significantly

The Thesis

GEODNET is a rare crypto asset: real revenue, real customers, real product-market fit, and token economics that tighten with scale.

The setup mirrors companies that 10x’d after crossing $5-7M ARR. The market (robotics/autonomy) is exploding. The token mechanics create permanent supply reduction as usage grows. The network effect compounds with each station.

At current valuation, the market is pricing in modest growth. If GEODNET executes even close to its current trajectory, the asymmetry is extreme.

This isn’t a momentum play or narrative trade. It’s a fundamental mispricing of a revenue-generating asset sitting at an inflection point.

The question isn’t whether robots need precise positioning, they objectively do. The question is whether GEODNET can maintain its growth rate as autonomy scales. The revenue says yes. The partnerships say yes. The network expansion says yes.

Position accordingly.

Disclosure: This is analysis, not financial advice. DYOR. Crypto is volatile. Only invest what you can afford to lose.

About Conglomerate

Conglomerate is a seasoned content writer and KOL in the crypto x AI x robotics space. Web3 gaming analyst, core contributor at The Core Loop, and pioneer of the onchain gaming hub and Crypto AI Resource Hub.

Book A Call

Curious how robotics and AI can drive your next growth wave? Let’s talk. Book a call with Crescendo’s CEO Shash!